APAC: The State of Mobile Advertising - Q2, 2015

Part 1: Mobile-device use and market share

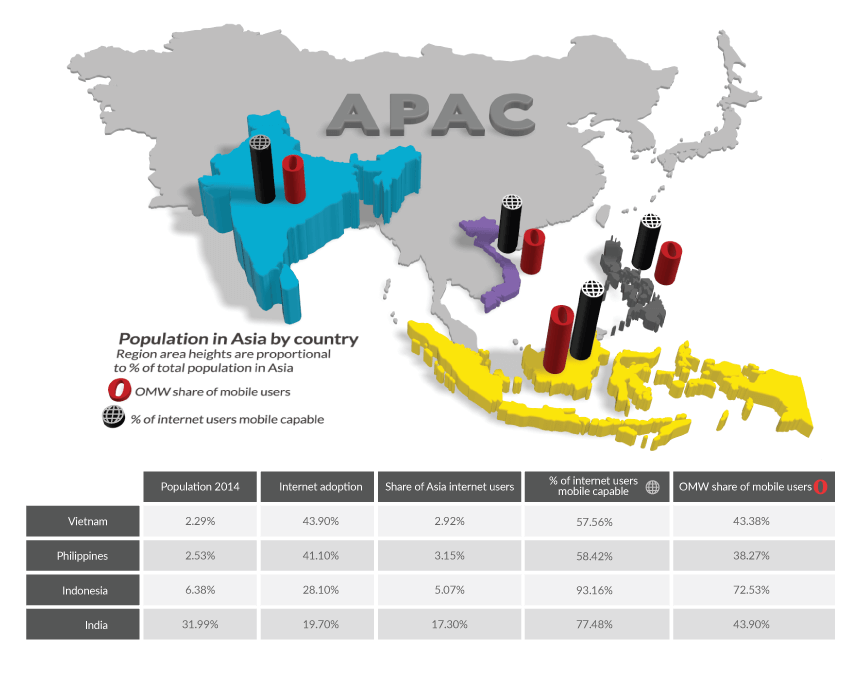

The P4 countries represent 43% of the population of Asia, yet they account for less than 30% of regional internet users. However, over 76% of these users access the internet using a mobile device. This group is led by Indonesia, where we estimate a remarkable 93% of internet users can access the web via a mobile device.

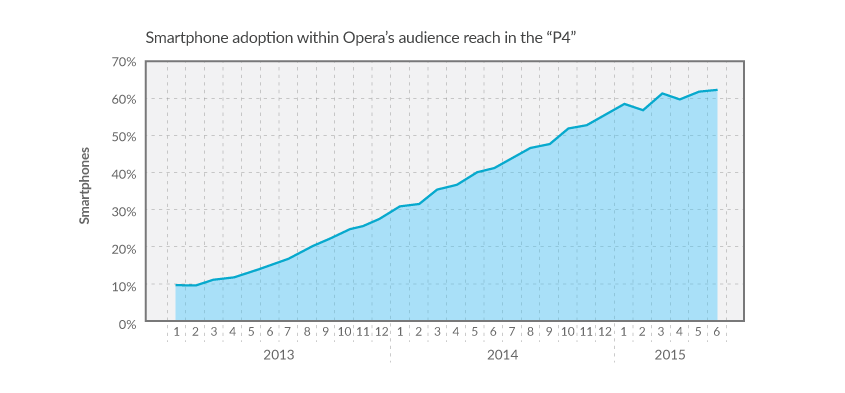

Despite the slower adoption of the mobile web (compared to Japan and Korea), the use of smartphones has seen impressive growth in the last two years. As shown in the chart, smartphone ownership has increased by over 545% since the beginning of 2013.

Asia has consistently been one of the top markets, both in terms of unique users accessing the Opera Mediaworks platform for advertising and for the number of impressions served to those users. Opera’s reach within this market is approximately 400 million unique users each month, across both apps and mobile web.

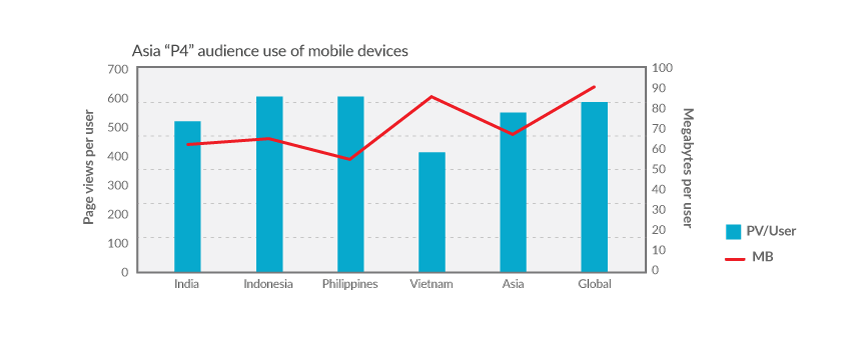

Indonesia, Philippines lead in page views, Vietnam in data use

Compared to global averages, as seen in our Q2 State of Mobile Advertising report, use of mobile websites and apps tends to be lower in the P4. However, this sub-region is on par with the rest of Asia, and both the Philippines and Indonesia exceed the global average for page views consumed per user. Vietnam trails the average volume of page views by a significant margin, but it has a sizeable lead in data consumption, with each user in Vietnam using 85 MB per month – very close to the global average of 90 MB/month.

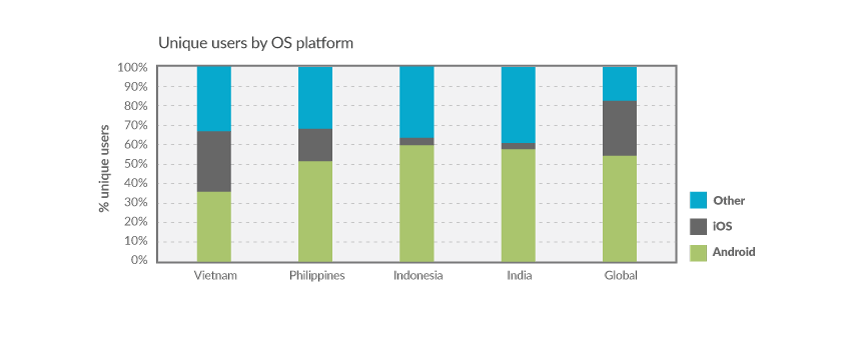

"Other devices still prevail in Asia and P4 sub-region"

The Asia region and the P4 have a much higher percentage of “other” devices (i.e., those with operating systems other than iOS or Android) than our global user base.

These devices tend to monetize at lower rates than Android or iOS, and they also tend to drive fewer impressions per user. However, in Asia – and more specifically, in our P4 region – these devices do drive a significant number of impressions.

Additionally, while the Asia region has easily maintained pace with the rest of the world in the adoption

of Android devices, adoption of iOS has been much slower, leaving a large, untapped smartphone market opportunity.

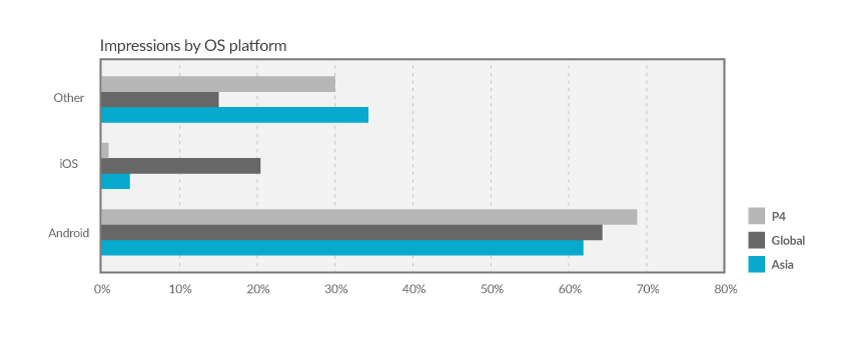

Android is market leader for impressions

Looking at the market share of each operating system (as measured by impressions served), it is clear that Android is dominating the market, driving the lion’s share of impressions globally, regionally (Asia) and also within the P4.

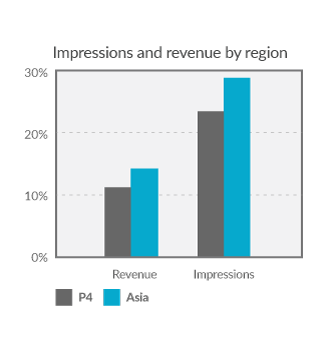

The no.1 obstacle to revenue growth

Due largely to the continuing presence (and large market share) of “Other” devices, which monetize at lower rates, the Asia region and the P4 both fall below the global averages for monetization potential, or the ratio of money earned to impressions served.

The P4 ratio of percentage of revenue to percentage of impressions is 0.47:1, just under that of APAC (0.49:1).

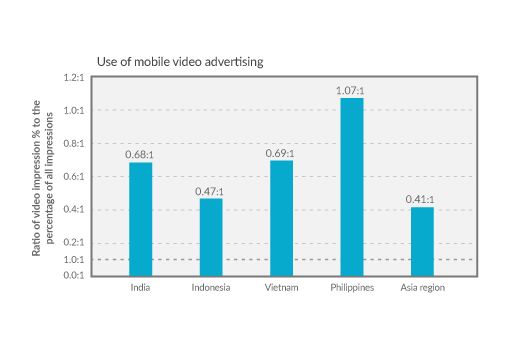

Demand for mobile video in the P4

Globally, we have witnessed increased demand for and rapid adoption of mobile video-ad units. Within the P4 region, the Philippines has the highest ratio of video-ad impressions compared to the volume of all impressions served in its market, and it also exceeded the expected global standard (ratio of 1:1). Both India and Vietnam exceeded the average across all of Asia (0.41:1).

Part 2: Mobile consumer behavior and trends

Frequent vs. occasional users

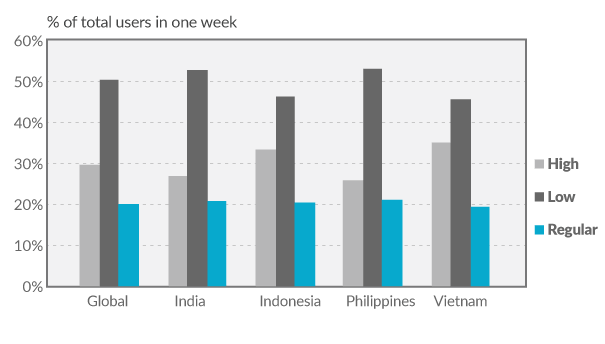

We categorized mobile video users into three groups:

“High” frequency users, who access mobile sites and apps five or more days each week

“Regular” users, who access mobile sites three or four days per week

“Low” volume users, who access mobile sites one or two days in a week

In our findings, we saw that both Vietnam and Indonesia have a higher percentage of high-frequency users than the global average, while India and the Philippines contain more low-frequency users. Interestingly, the “regular” frequency group for the P4 are all similar in market share and are also quite close to the global average.

Most popular types of mobile content

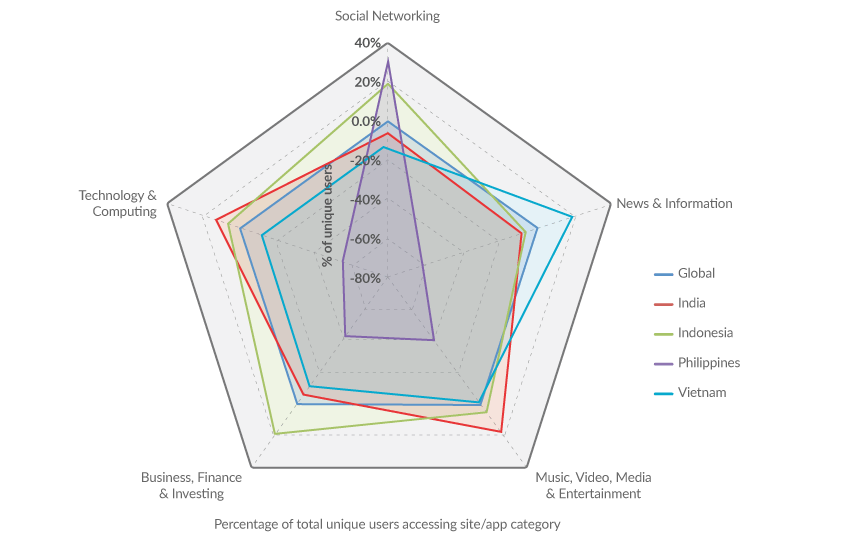

Considering the volume of active users, there are five media categories that lead the pack across the P4 region:

- Social Networking

- News & Information

- Arts & Entertainment

- Business & Finance

- Technology & Computing

However, as shown in the chart, user interest in these categories varies significantly within the sub-region and also when compared to our global data set. For instance, when compared to the global average:

- Social Networking is far more popular in the Philippines than other markets, but interest in other categories wanes, particularly for News.

- Indonesians also top the global average for Social Networking use, but far outpace the rest of the world when it comes to consumption of Business content.

- Vietnam shows a strong preference for News.

- In India, mobile users are visiting more sites and apps in the Music, Video, Media & Entertainment and the Technology & Computing categories than the average global user.

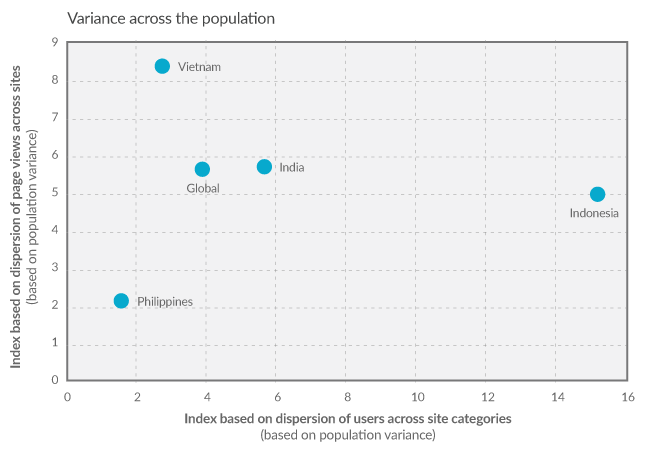

Diversity of mobile consumption

Do mobile users in these countries spend most of their time and attention on one or two types of mobile content, or do they have a broad set of interests? We examined the dispersion of users across site and app categories. The chart below compares the dispersion of each country's users' page views across sites (vertical axis) with the dispersion of unique users across sites (horizontal axis). The horizontal axis can be envisioned as how many different sites the average user visits. The vertical axis depicts the extent to which users disperse their page views across the different sites they visit.

We found that:

- Indonesian users have a broad range of interests, with significantly more users engaging in cross-site/app activity than our global average (or the Philippines, where cross-site interest is low). As such, cross-site behavioral advertising has the greatest potential in Indonesia.

- Vietnam, while having a low level of cross-site activity, are extremely loyal and, therefore distribute their total page views across a small group of sites and apps. So, in Vietnam, contextual targeting would be the most successful approach.

- Filipino users focus their interests and their page views on a very small, select group of sites and apps, making success in advertising dependent on close partnerships with those top publishers.

Part 3: Traffic and revenue breakdown

Top media categories, by overall traffic volume

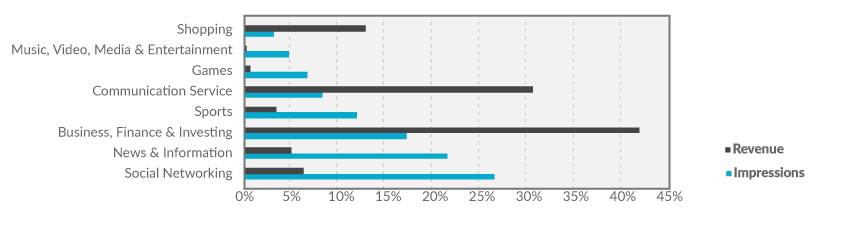

On a global level, Social Networking is the top category in terms of total mobile traffic, as measured by impressions. This holds true as well in the P4 region, where 26.5% of all impressions are served on Social Networking sites and apps.

However, when it comes to revenue, there is a big difference. Globally, Social Networking leads in total revenue generation, but in the P4 region, Business, Finance & Investing sites and apps are the clear winner. They are responsible for nearly 42% of the revenue paid to publishers across the P4 sub-region.

Revenue winners: Business & Finance, Communication Services

When we compare the top media categories in the P4 region with the global market, we find some significant differences around share of impressions served and the amount of revenue delivered to publishers.

- Social Networking leads for impressions served in both the global and P4 sub-markets, but it falls well short of the lead position for revenue generation across the P4 countries.

- News & Information, while a solid performer in both markets for impressions, underperforms when it comes to revenue generation.

- In contrast, the Business, Finance & Investing category, as well as the Communication Services category, performs much better in the P4 than globally for both impression volume and revenue generation.

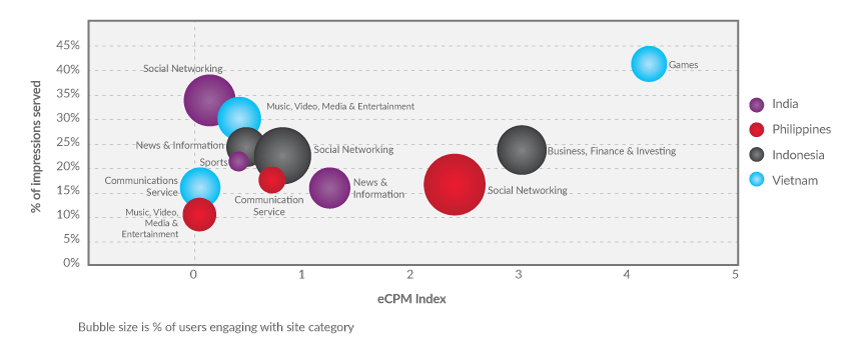

Monetization tactics and levels vary by category, country

Given the variable levels of interest and degrees of engagement in each media category shown by each of the countries in the P4, it is not surprising that there are are significant differences in monetization models.

The chart below shows the top three publisher categories in each country and compares them by percentage of users engaging with that media category (bubble size), the relative eCPM paid for impressions by advertisers and the percentage of impressions the site category generates on our platform.

Here we can see:

- There is a wide range of eCPM paid to publishers in the region. At the high end of the range is the Games category, fueled by the Vietnamese market. In fact, Vietnam is the only country in the P4 where Games ranked in the top three. Globally, the Games category also demands a fairly high premium, but it does not drive nearly as large of a percentage of our global impression volume, so Vietnam is somewhat unique in this regard.

- Having a large number of users does not necessarily drive higher eCPM. Social Networking sites and apps had the greatest percentage of users in each of the countries that make up the P4. However, only in the case of the Philippines did this leadership position result in the highest eCPM rate. This was true even as the Social Networking properties in the Philippines had the lowest percentage of impressions across the entire region.

Methodology

Information contained in this report is based on aggregated information obtained from the Opera Mediaworks mobile advertising platform and mobile ad exchange servers. The data presented represents traffic and monetization metrics and statistics compiled across multiple advertising campaigns delivered by us to our mobile publisher customers. The data includes ads requested from and delivered by us on behalf of multiple ad networks as well as directly sold campaigns created by our customers themselves. Country level details are based on IP addresses of the originating ad requests as forwarded to us by our mobile publisher/app developer customers. Device details are similarly based on device user agents provided by these same customers.

Campaign Spotlight

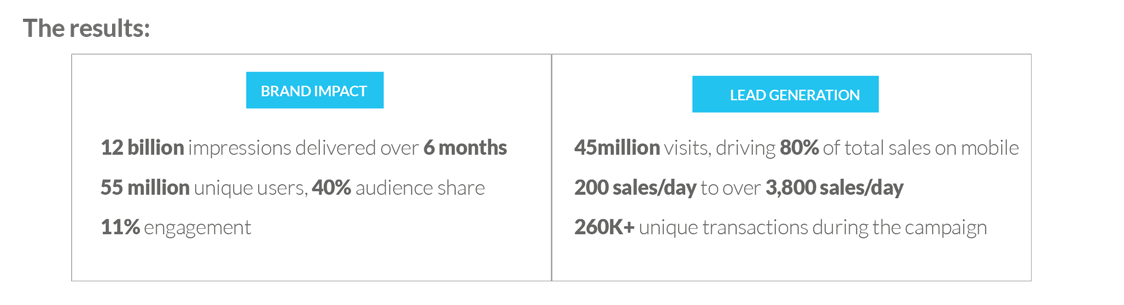

The AskMeBazaar mobile engagement campaign is first in its class . No other brand or company has ever customized a mobile campaign to this extent, from the first contact with the consumer to the targeted delivery of specific creative developed for the user. It succeeded in disrupting the e-commerce market in India and it also demonstrated the power of utilizing great technology and consumer insights to redefine a sector. The result not only succeeded in disrupting the e-commerce market in India but it demonstrated the power of utilizing great technology and consumer insights to redefine a sector.

The goal:

AskMe, known primarily as India’s Yellow Pages, wanted to challenge the market in India by launching AskMeBazaar.com to be the e-commerce site of choice among all consumers.

The target audience:

India’s 55 million active Opera mobile browser users.

The strategy:

Opera Mediaworks, together with AskMeBazaar, studied how to attract the new brands’ early adopters and the m-commerce heavy users by leveraging the catalog offering of AskMeBazaar.

Over 12 audience segments (personas) were identified and served only the most relevant ads with customized product categories by using “Surf DNA,” our proprietary targeting technology, which attracted the best transacting customers and increased campaign efficiency in a major way.

For example, one of the audience segments, identified as the “High Rollers” segment, were served specific advertisements fo relevant products such as watches and optical wear, luxury bags & luggage, jewelry, art & decorative items, furnishings, laptops, fitness equipment, etc..

More than 1,500 creatives were delivered each week to the targeted audience segments. Over 200 campaigns ran across the 12+ specific audience segments with matching 34 categories of relevant products found on AskMeBazaar.

The Results:

Combining the insights from user behaviors, AskMeBazaar was able to provide the best performing CTR products (deals), add similar deals and more importantly remove non-performing products.

Asia as defined by the UN

Southern Asia

- Afghanistan

- Bangladesh

- Bhutan

- India

- Iran (Islamic Republic of)

- Maldives

- Nepal

- Pakistan

- Sri Lanka

South-Eastern Asia

- Brunei Darussalam

- Cambodia

- Indonesia

- Lao People's Democratic Republic

- Malaysia

- Myanmar

- Philippines

- Singapore

- Thailand

- Timor-Leste

- Viet Nam

Central Asia

- Kazakhstan

- Kyrgyzstan

- Tajikistan

- Turkmenistan

- Uzbekistan

Eastern Asia

- China

- China, Hong Kong Special Administrative Region

- China, Macao Special Administrative Region

- Democratic People's Republic of Korea

- Japan

- Mongolia

- Republic of Korea

Not Included

- Western Asia

- Armenia

- Azerbaijan

- Bahrain

- Cyprus

- Georgia

- Iraq

- Israel

- Jordan

- Kuwait

- Lebanon

- Oman

- Qatar

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- Turkey

- United Arab Emirates

- Yemen

Monetization tactics and levels vary by category, country

Given the variable levels of interest and degrees of engagement in each media category shown by each of the countries in the P4, it is not surprising that there are are significant differences in monetization models.

The chart below shows the top three publisher categories in each country and compares them by percentage of users engaging with that media category (bubble size), the relative eCPM paid for impressions by advertisers and the percentage of impressions the site category generates on our platform.

Here we can see:

- There is a wide range of eCPM paid to publishers in the region. At the high end of the range is the Games category, fueled by the Vietnamese market. In fact, Vietnam is the only country in the P4 where Games ranked in the top three. Globally, the Games category also demands a fairly high premium, but it does not drive nearly as large of a percentage of our global impression volume, so Vietnam is somewhat unique in this regard.

- Having a large number of users does not necessarily drive higher eCPM. Social Networking sites and apps had the greatest percentage of users in each of the countries that make up the P4. However, only in the case of the Philippines did this leadership position result in the highest eCPM rate. This was true even as the Social Networking properties in the Philippines had the lowest percentage of impressions across the entire region.