Year closes out with Apple No. 1 for revenue, Android leading in traffic

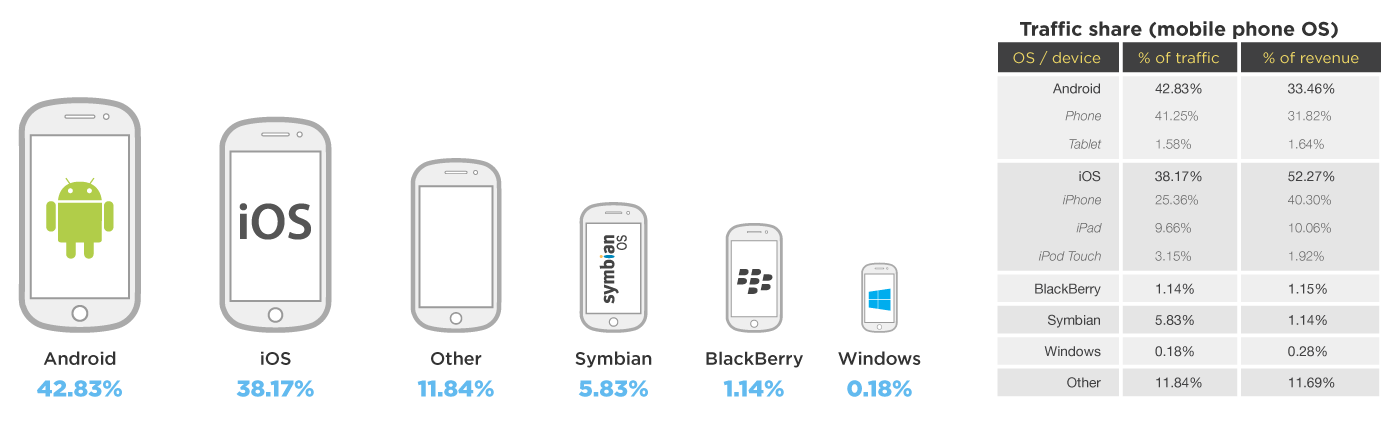

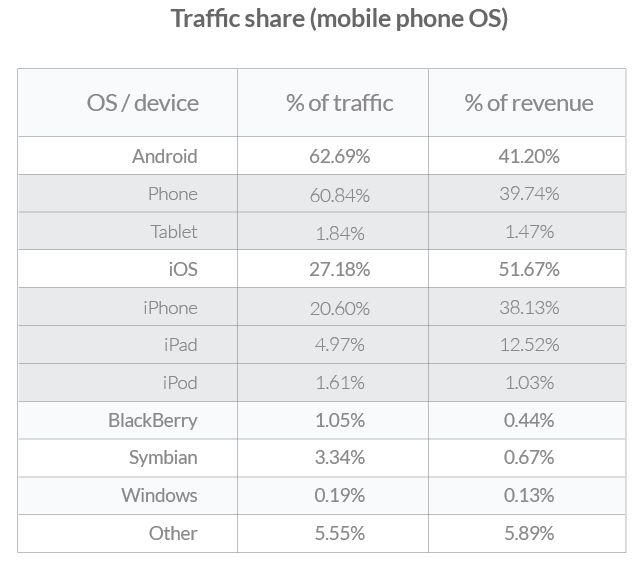

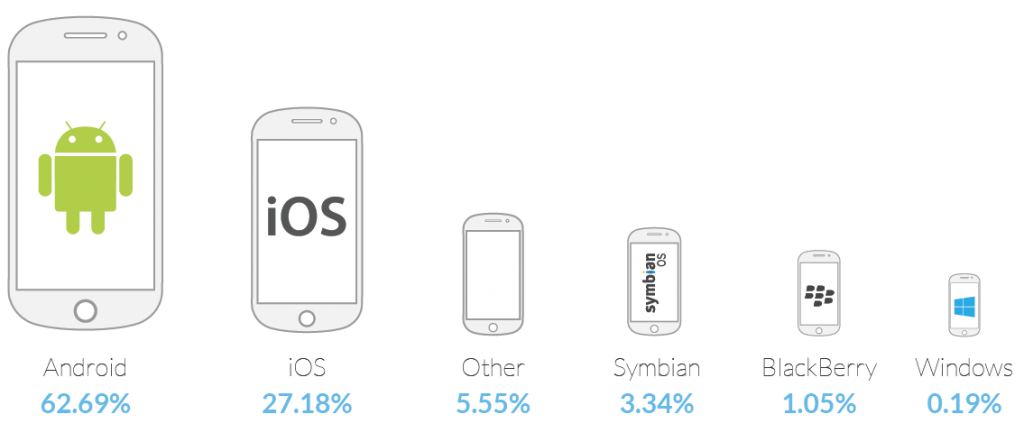

Over the course of 2014, there were significant changes in terms of revenue and traffic generated across the two leading device operating systems — Android and iOS. Foremost, Android overtook iOS in ad impressions served and now dominates the market by this measure.

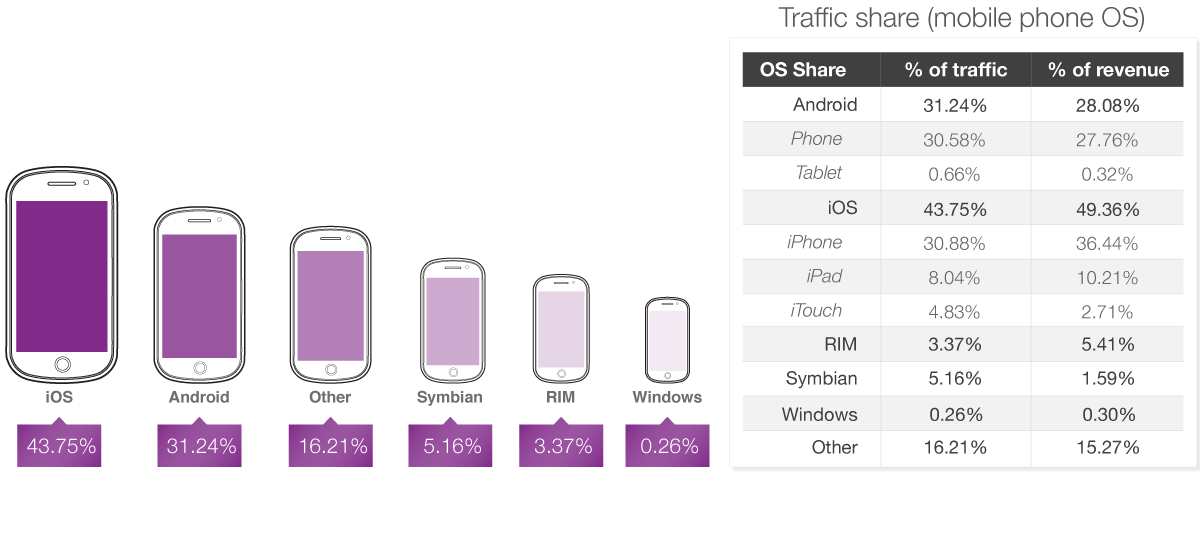

Here is a throwback to the pre-Android dominance era, where, in 2009, between the iPhone and iPod Touch, Apple had 45% of the market, BlackBerry had 10% and the Sidekick had an 8% share. The “other” category primarily reflects feature phones, which have been rapidly replaced by smartphone models.

Android may have expanded and taken the lead in traffic, but iOS retained its solid lead for revenue generation and monetization. Apple’s tenacious grip on revenue generation is driven to a large extent by its favorable market position in western markets, such as the United States, Germany and the United Kingdom. In these markets, rich media and video advertising are more common and the high volume of mobile application usage (vs. mobile browsing) drives a robust user acquisition market.

Android nabs majority of traffic; iOS wins in revenue

As 2014 drew to a close, more than 6 in 10 ad impressions were served on Android phones, with almost 3 in 10 served on iPhones, and the rest on Symbian, Windows and BlackBerry, among others.

iPad monetization has also stabilized, back down to its Q4 norm of between 12 and 13%, which is high considering it has a mere 5% share of impressions. The previous quarter saw a lifetime peak at more than 17% of revenue with under 7% of impressions. So, the iPad continues to show remarkable monetization capabilities.

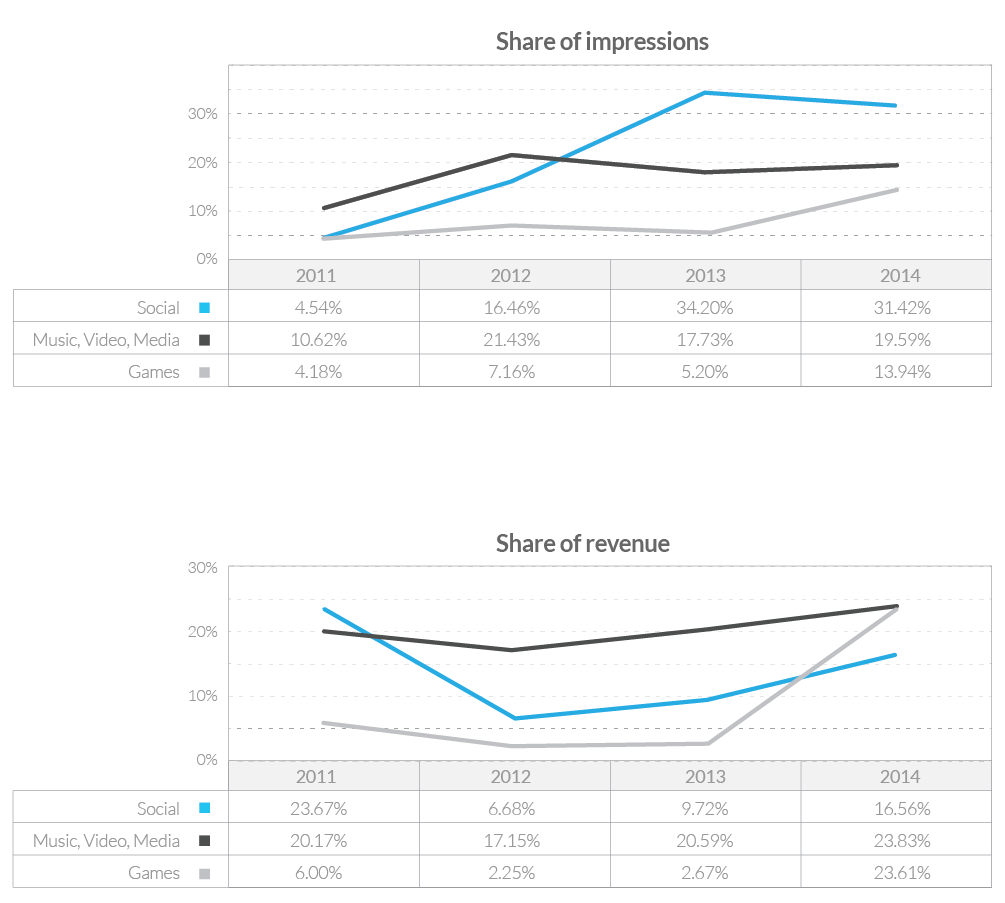

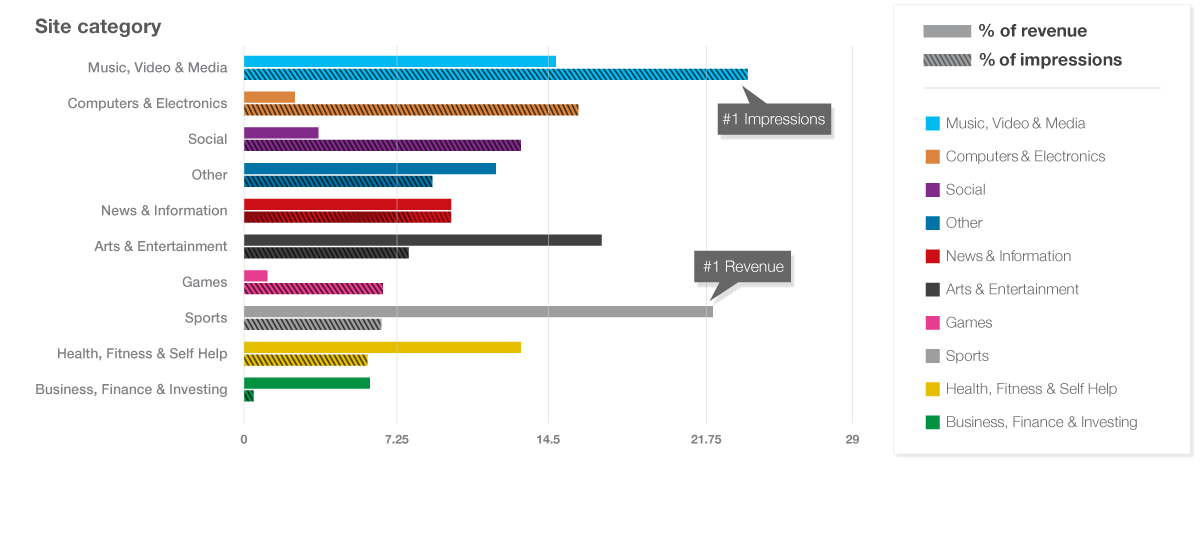

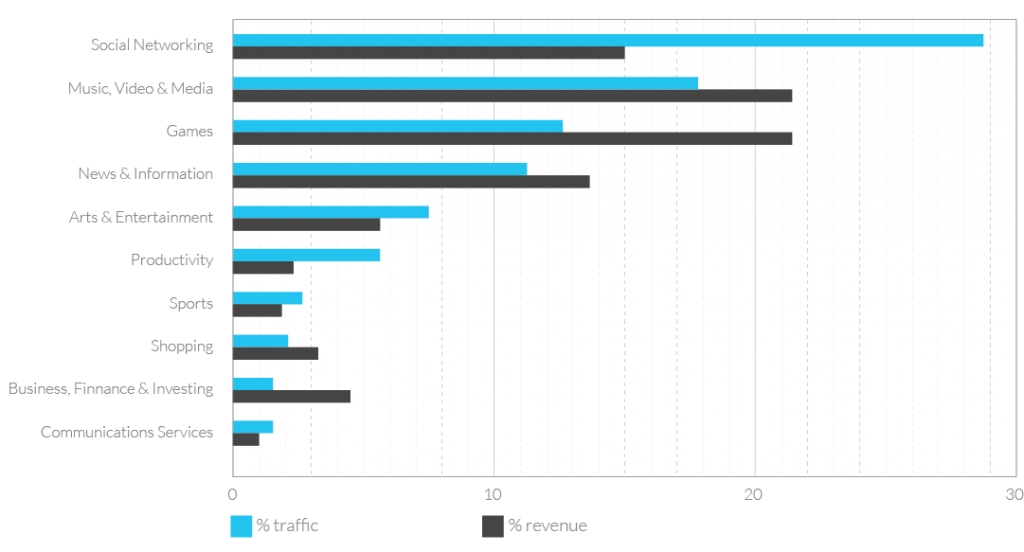

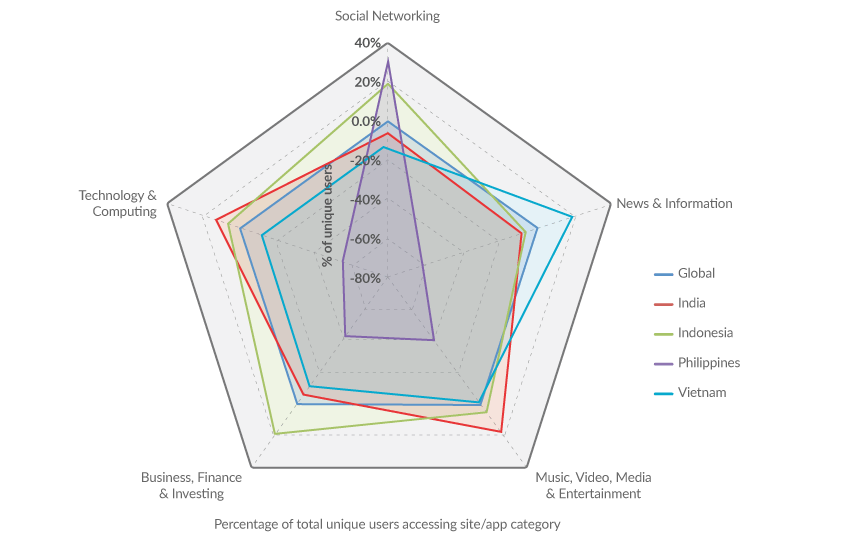

Social sites, apps get most traffic; Music, Video & Media is No. 1 for revenue

Over the past few years three categories of mobile sites and applications have been clear leaders in traffic volume and revenue generation:

- Social Networking

- Music, Video & Media

- Games

Though these categories sometimes change their relative positions, or on occasion, get displaced by another category — they continue to be the key categories of mobile media consumption.

More impressive, however, is its growth in production of revenue. In December 2013, Games represented less than 3% of revenue on the platform. By December 2014, the category produced nearly 24% of revenue and is now in a virtual dead heat with Music, Video & Media for the top spot.

Taking a step back and looking at year-over-year data, we can see that within these three categories, Games is the big success story in 2014. As the graph shows, gaming sites and apps represented just 5% of our impression volume in 2013 but has jumped to nearly 14% this quarter.

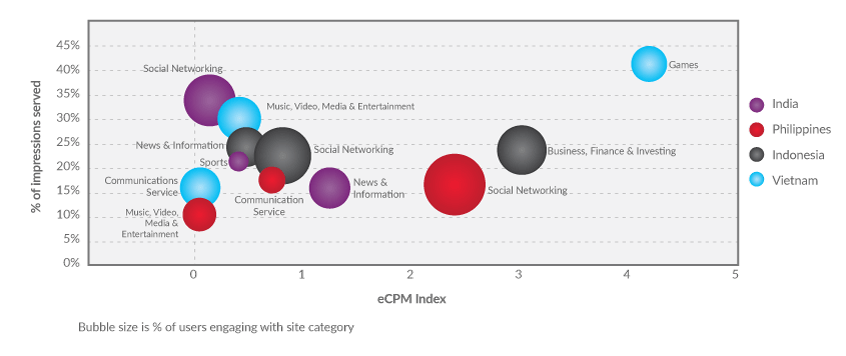

As with many past quarters, 2014 ends with the Business, Finance & Investing category showing the greatest monetization capacity. That is, on a per impression basis, these sites and applications command the highest price from advertisers.

The mobile ad market truly globalizes

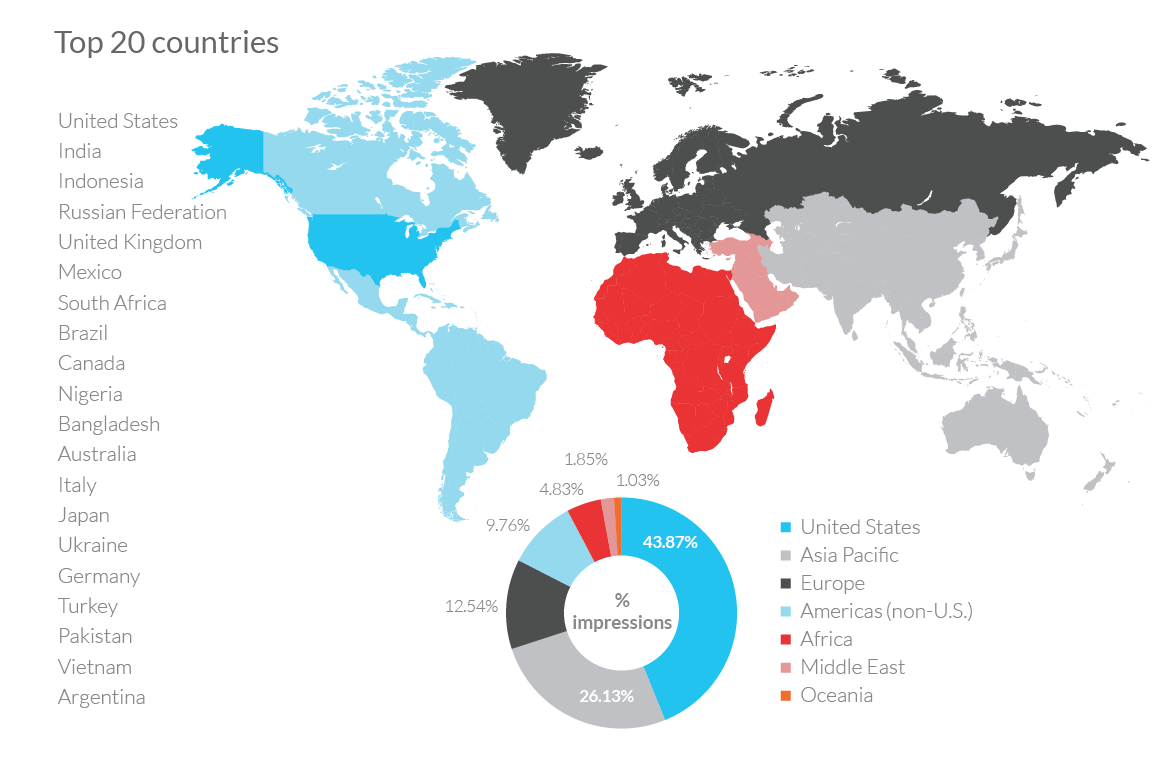

When we published the first mobile advertising marketing report in early 2010, the United States was overwhelmingly our largest market as measured by impression volume and revenue generation. Even two years later, when we released the first edition of The State of Mobile Advertising report in Q2 2012, traffic to mobile consumers in the United States dominated the platform, accounting for over 73% of impressions served.

Over the past few years, however, non-U.S. markets began to capture more share, and we witnessed a true “globalization” of mobile advertising. At first (2011-2012), it seemed that Europe was the fastest growing market, but it soon became apparent that Asia Pacific countries were accelerating at a faster pace.

By the end of 2014, we also see the Americas (non-U.S.) and Africa catching up somewhat to start playing a larger role within the international market, with 9.8% and 4.8% respectively. Africa’s growth, up from just 1% in 2013, is the most notable.

And yet, despite the globalization trend, the United States still drives the greatest share of both traffic and revenue.

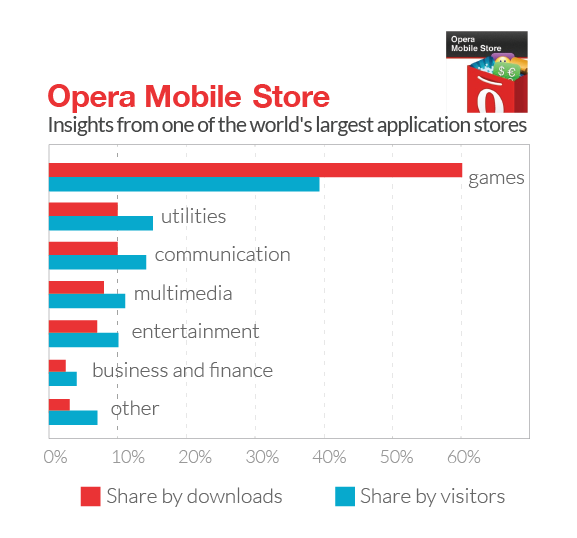

The mobile app ecosystem

As we begin 2015, mobile advertising is undoubtedly surging in every corner of the globe. The mobile ecosystem in many of our global markets has a significant, often major, portion, which is driven by applications downloaded and installed on smartphones. These applications range across all types of media categories and deliver both an enhanced user experience to the consumer and a robust delivery platform for advertisers. However, to be successful the media channel must have a successful user acquisition strategy, which in itself is driven by advertising.

Special focus: User acquisition and monetization

To be successful, mobile websites and applications must continually acquire and retain users. In today’s diverse mobile marketplace, this is neither simple to plan for nor easy to accomplish. Even if successful in obtaining users with a call to action that drives a download or visit, users inevitably churn off (no longer use) the application or visit the site, or reduce the frequency of their use. As shown on the chart below (derived from a single example), the loss of initial users can be rapid and large.

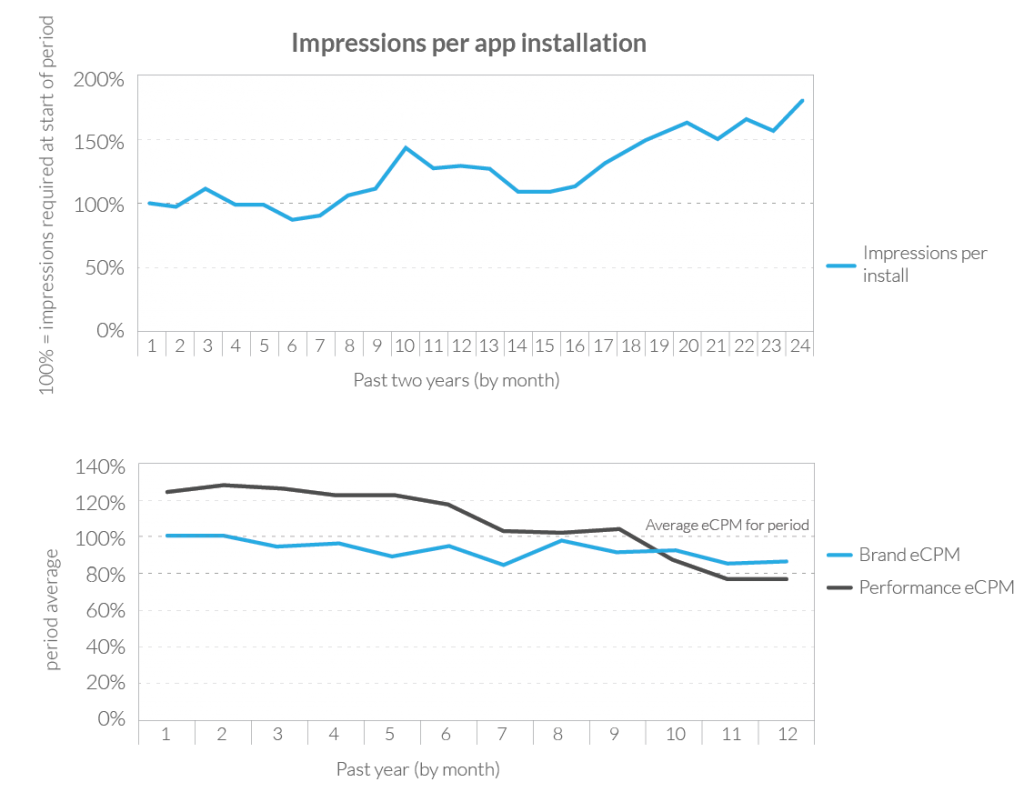

Acquisition cost vs advertising revenue potential

However, while rates to acquire the customer are stable or declining, the number of impressions required to win a new customer is increasing, thus reducing the effective revenue (cost) per impression (eCPM) achieved by the media property (app or site) displaying the performance campaign.

The impact of this declining eCPM from CPI campaigns is that average brand advertising eCPMs are at least equal to performance rates, and brand advertisers can now win impressions away from performance advertisers.

- A mere analysis of average cost disguises the critical factor of session depth. Performance campaigns (e.g., CPI campaigns for games) can generate significantly higher rates of installations – and therefore eCPM – when the impression is observed early in the user session. High session depth traffic can still generate clicks for brand campaigns, but they generally do not achieve user acquisition (conversion). As shown below, click-through rates (CTR) for early session impressions significantly outperform later impressions.

- Because impression depth is such an important factor, the choice of ad platform is critical. To achieve early impressions, the network must have direct connections to the media property where the user acquisition campaign will appear. Furthermore, that network’s reach must include the audience appropriate for the target market of the application. In short, direct connections plus robust and the appropriate audience = success.

- The impact of an advertiser providing a high CPI, coupled with a high conversion rate (i.e., have a low impression requirements per installation) means that advertisers’ campaigns get priority over other campaigns. Performance advertisers with lower conversion rates must increase their CPI to compete effectively for inventory. Similarly, in a market where brand advertisers are now competitive with performance eCPM rates, developers seeking new users via performance campaigns must also compete with brands. If unwilling or unable to provide the higher CPI, the developer is left to compete for less desirable inventory.

- Application providers should diversify their monetization scheme. This can include in-application purchases, but must also address different advertising models and how much those models will pay for the available inventory. Without a solid understanding of audience characteristics and behaviors, the value of any app or site’s inventory is reduced. Therefore, it is critical to have the ability to target in a secure manner that is also sensitive to the privacy concerns of the user.